Late payment action needed as base rate stays put in, say small businesses.

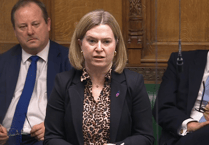

Responding to the Bank of England’s Monetary Policy Committee’s vote to keep the base rate at 4.25%, Tina McKenzie, Policy Chair, Federation of Small Businesses (FSB) said: “Today’s decision on the base rate was not unexpected, given recent inflation readings being higher than the Bank of England’s target.

“However, small firms will be hoping to see cuts later in the year, in order to improve their access to funding. Over four times as many small firms rated the availability of new credit as poor than rated it as good, according to FSB’s most recent Small Business Index.

Andrew Bailey, the Governor of the Bank voted to maintain the current level, along with the majority of the committee. “Interest rates remain on a gradual downward path, although we’ve left them on hold today,” Mr Bailey told The Telegraph.

Tina McKenzie explains: “High interest rates unfortunately translate to worse problems with late payment, as large corporates which are feeling pressure from their own leveraged positions use their suppliers as a source of, essentially, free credit.

“The forthcoming Industrial Strategy should follow on from the Government’s welcome plan to tackle late payment by banning large firms with poor payment practices from applying for grants.

“Meanwhile, the plans for audit committees and boards of large businesses to oversee and review payment practices, to improve transparency and accountability, cannot be brought in soon enough.

“Stamping out late payment will mean far fewer small firms having to apply for emergency loans to keep themselves afloat while waiting for invoices to be paid – something that causes even greater pain in a high interest rate environment.”

Comments

This article has no comments yet. Be the first to leave a comment.